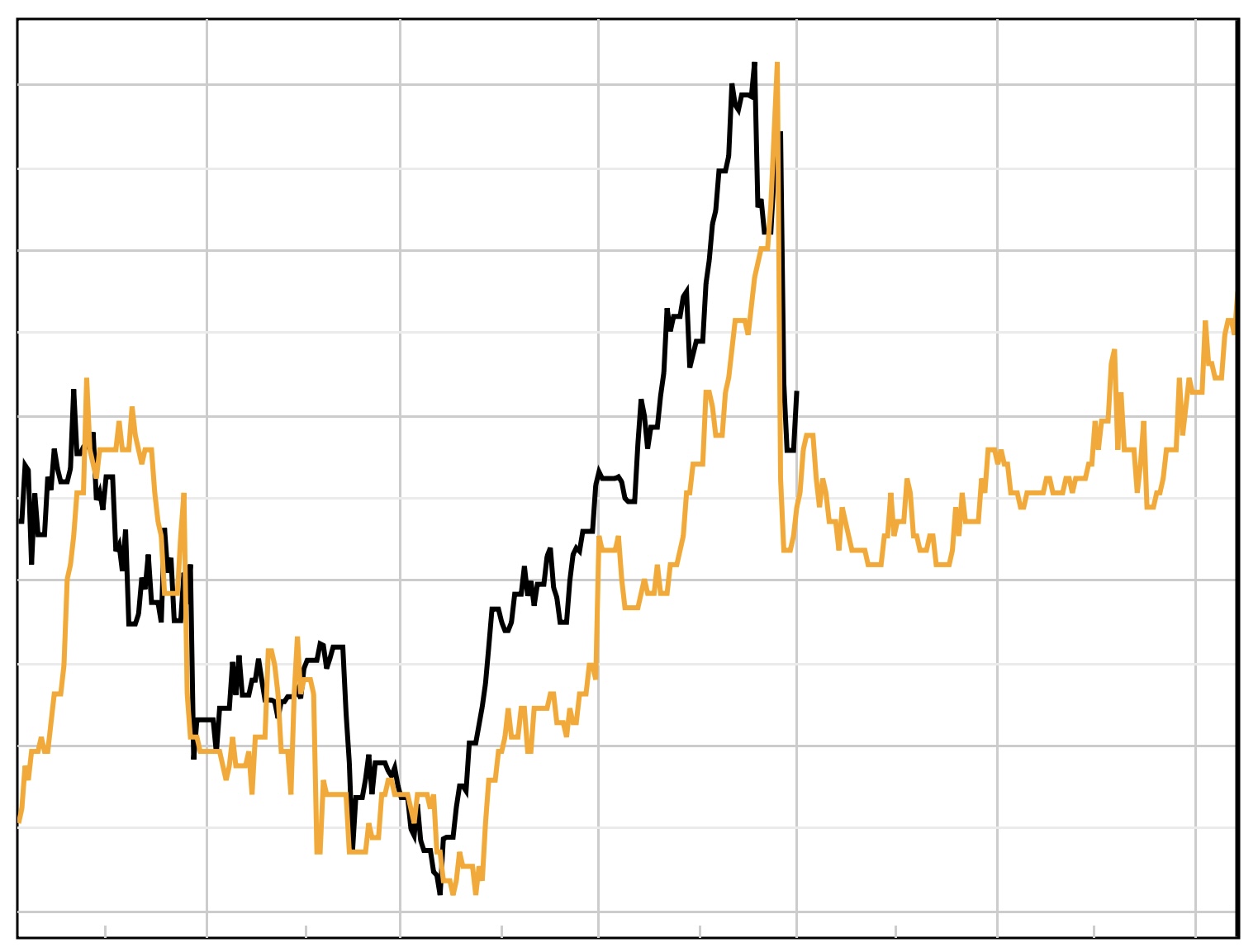

In trading, it’s not uncommon to observe that a financial asset, such as a stock, an index, or another instrument, can exhibit a similar pattern or behavior as it did in another past year. This phenomenon can occur due to a variety of reasons, and understanding these can help traders anticipate future movements and make more informed decisions.

1. Recurring Economic and Business Cycles

One of the primary reasons an asset might follow a similar pattern from one year to another is the recurring nature of economic and business cycles. Many businesses and industries experience seasonal patterns in their earnings and operations. For example, retail companies often see increased sales during the holiday season at the end of the year. Similarly, agricultural stocks might follow a pattern tied to planting and harvesting seasons.

When these cycles repeat annually, the stocks or indices related to these industries might also show similar price movements year after year. Traders can use this information to anticipate when an asset might rise or fall based on its historical behavior during the same period.

2. Investor Behavior and Market Sentiment

Another factor is the behavior of investors and the overall market sentiment. Human psychology plays a significant role in financial markets. Investors tend to react to similar news or economic conditions in similar ways, which can lead to repetitive patterns in asset prices.

For example, if a particular event caused a stock to drop last year and a similar event occurs this year, there’s a good chance that the stock might experience a similar drop. This is because the investors’ reactions to the news are likely to mirror their previous responses, creating a similar price movement.

3. Corporate Events and Earnings Reports

Corporate events, such as earnings reports, dividends, mergers, and product launches, often happen around the same time each year. These events can have a significant impact on a company’s stock price. For instance, if a company typically reports strong earnings in a particular quarter, investors might anticipate this and drive the stock price up in advance, replicating the pattern from previous years.

As these events recur annually, the stock might show a similar trend during the same period each year, making it easier to predict short-term movements.

4. Macroeconomic Factors

Macroeconomic factors such as interest rates, inflation, and government policies also tend to follow cyclical patterns. Central banks, for example, often follow similar timelines for policy announcements or interest rate changes, which can influence entire markets in a similar way each year.

For example, if the Federal Reserve raises interest rates in the summer of one year, and they do the same the following year, stock markets might react in a comparable way, causing similar trends across the same months.

5. Supply and Demand Dynamics

Finally, the basic principles of supply and demand can lead to repetitive patterns in asset prices. Certain commodities, for example, are influenced by predictable changes in supply and demand. If supply decreases at the same time every year due to seasonal factors, prices may rise in a similar pattern year after year.

Similarly, if demand for a product increases during a specific period each year (like consumer electronics during holiday seasons), the companies producing these products may see their stock prices rise in a predictable manner.

Conclusion

In summary, the reason why a financial asset can have a similar pattern to another past year lies in the repetitive nature of economic cycles, investor behavior, corporate events, macroeconomic factors, and supply and demand dynamics. These factors create conditions that often lead to similar outcomes, allowing traders to use historical patterns to anticipate future movements. By recognizing these patterns, traders can make more informed decisions and potentially improve their chances of success in the market.