ASSET NAME: WisdomTree U.S. Quality Dividend Growth Fund

Today we want to report on the WisdomTree U.S. Quality Dividend Growth Fund, as it presents solid fundamentals for a possible buy trading strategy. The seasonality index is now at 97%, while the results in past years in the trading window present a very strong and accurate trend.

The trading period is 70gg, so enough to monitor it well.

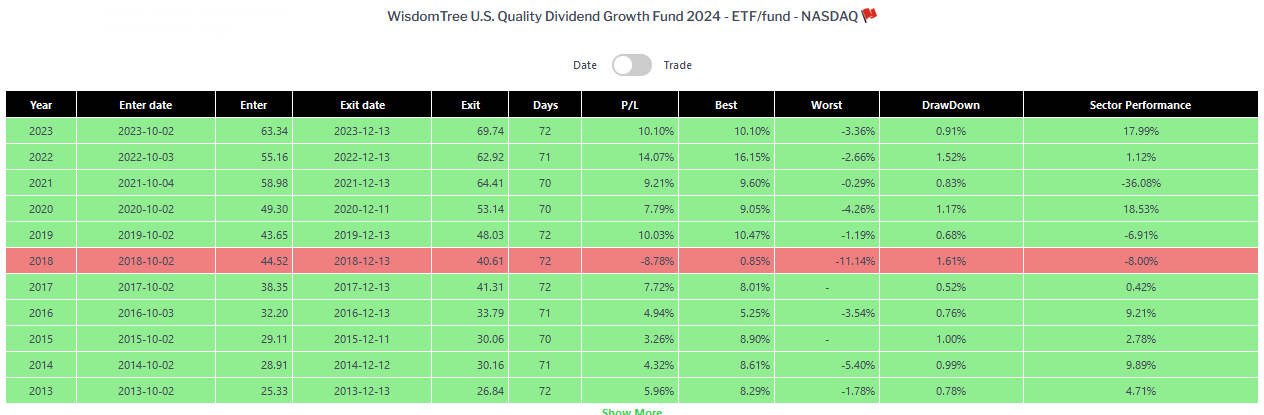

The history is based on 11 years of backtesting, which using a strategy based on entry and exit dates resulted in 10 wins. The average Profit is 6.2%, with a Best average of 8.6% and a worst of only -3.7%.

In the backtest using a Take Profit of 8% and a stop loss of 6% the wins were 10 out of 11 (in 2016 the trade exit still occurred by exit day as the take profi was not reached).

The past years with a trend that shows correlation with the current are 2017 and 2014. Both had positive outcomes with strong and definite direction. In 2014 the entry into the trade window was bearish until 10/10, this also happened in 2018, so care must be taken.

Conclusion

The strategy has many interesting seasonal indicators, the period is over 2 months, and the fund by its nature is a good asset for seasonal trading. Place caution by monitoring price behavior in the period before the entry date.

Notes

Free registration is required to analyze the trade with the interactive features.

Once a week comes you can participate in the free, closed-number, webinar that explains how to trade simple seasonal strategies with the help of Sayseason. Feel free to contact us here to get more information.

Disclaimer

Past results and strategies published on Sayseason are provided for informational purposes only and are therefore not indicative and do not guarantee future results.